Irs 2024 Schedule D – The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . The IRS has announced its 2024 inflation adjustments. And while U.S. income tax rates will remain the same during the next two tax years, the tax brackets—the buckets of income that are taxed at .

Irs 2024 Schedule D

Source : m.youtube.com

Articles of interest related to business accounting, INTERAC

Source : www.intersoftsystems.com

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

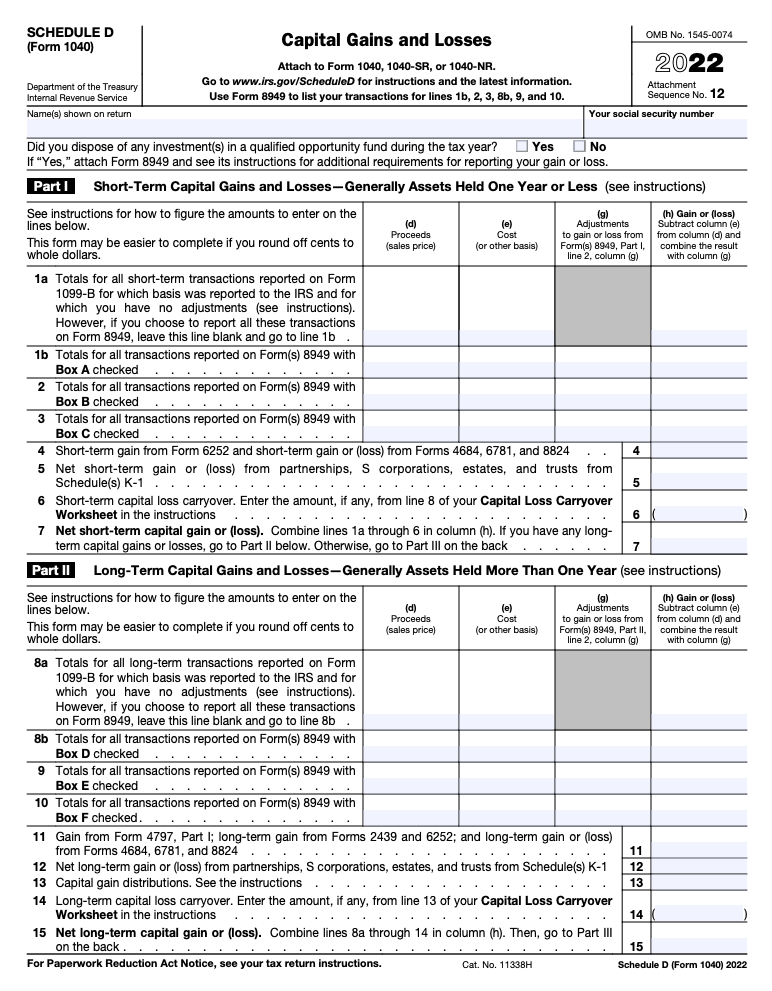

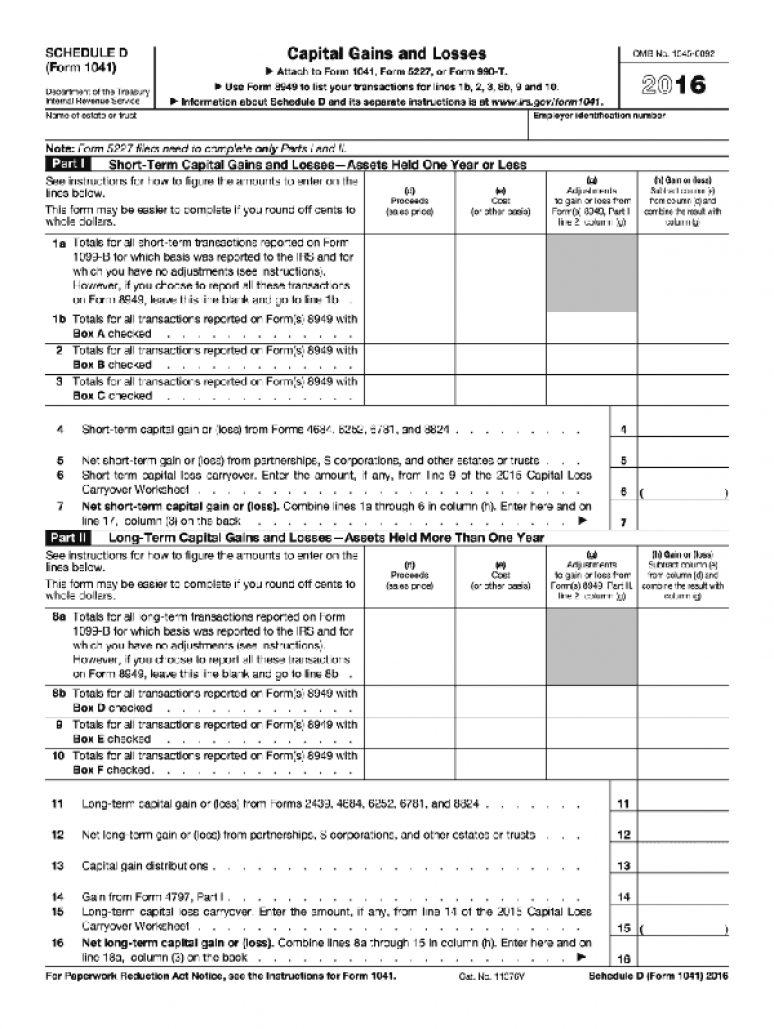

Capital Gains and Losses, IRS Tax Form Schedule D 2016 (Package of

Source : bookstore.gpo.gov

When Would I Have to Fill Out a Schedule D IRS Form?

Source : www.investopedia.com

A bipartisan bill aims to protect journalists from being forced to

Source : www.cnn.com

IRS Schedule D Walkthrough (Capital Gains and Losses) YouTube

Source : m.youtube.com

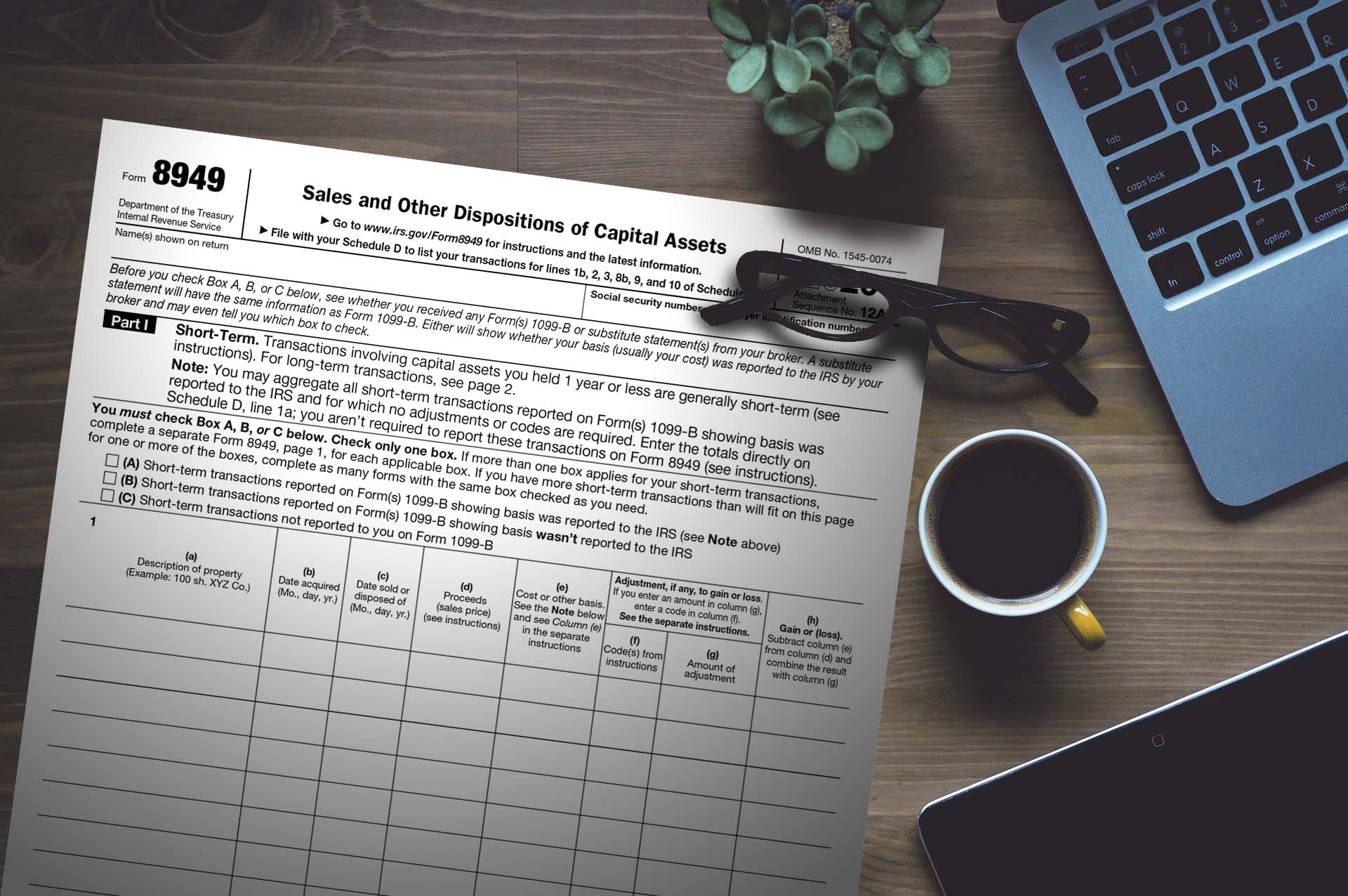

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

What Is Schedule D? How To Report Capital Gains And Losses

Source : thecollegeinvestor.com

Irs 2024 Schedule D Schedule D Tax Worksheet walkthrough YouTube: The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)